Monday, December 24, 2007

Important Notice

Dear Participant,

i2I 2008, the National Level Business Plan Competition of IIM Calcutta, is taking another step ahead in its endeavor to churn out the real entrepreneur in you as well as to help you prepare a robust business plan. Hope, this mail finds you amidst preparing for the final Business Plan formulation as well as Stage II.

We, along with our partner organization Seedfund, invite you to send us a video of your pitch explaining the business idea for the second stage by 31st December,2007. The idea of this activity being that your video shall be screened on a strictly NON - EVALUATIVE basis by both academia at IIM Calcutta and Seedfund officials and we shall be providing you feedback before January 10th,2007. The exercise is purely optional but we believe that all teams should take it seriously as this shall definitely help them in fine tuning their pitch before the final delivery during the Stage II.

Details of Video Upload

* The videos are to be uploaded on the same link on thebig.tv, (http://www.thebig.tv/contests_home.php?urlkey=pitch) with the same team and business names.

* The video shouldn't exceed 5 minutes

* Last Date for submission: 31st December, 2007

Also, we have modified the structure of the pitch round - Stage II to make it more interactive:

- 5 minutes of Pitch

- 8 minutes of cross questions

- 2 minutes of feedback

i2I 2008, the National Level Business Plan Competition of IIM Calcutta, is taking another step ahead in its endeavor to churn out the real entrepreneur in you as well as to help you prepare a robust business plan. Hope, this mail finds you amidst preparing for the final Business Plan formulation as well as Stage II.

We, along with our partner organization Seedfund, invite you to send us a video of your pitch explaining the business idea for the second stage by 31st December,2007. The idea of this activity being that your video shall be screened on a strictly NON - EVALUATIVE basis by both academia at IIM Calcutta and Seedfund officials and we shall be providing you feedback before January 10th,2007. The exercise is purely optional but we believe that all teams should take it seriously as this shall definitely help them in fine tuning their pitch before the final delivery during the Stage II.

Details of Video Upload

* The videos are to be uploaded on the same link on thebig.tv, (http://www.thebig.tv/contests_home.php?urlkey=pitch) with the same team and business names.

* The video shouldn't exceed 5 minutes

* Last Date for submission: 31st December, 2007

Also, we have modified the structure of the pitch round - Stage II to make it more interactive:

- 5 minutes of Pitch

- 8 minutes of cross questions

- 2 minutes of feedback

Wednesday, December 12, 2007

BV Phani

Profile:

Faculty, Finance

IME-IITKanpur

Coordinator

SIDBI Innovation & Incubation Centre

Indian Institute of Technology Kanpur, Kanpur 208016, Uttar Pradesh, India

Publications

2007 B.V.Phani, Chinmoy Ghosh & John Harding. “Does Liberalization Reduce Agency Costs? Evidence from the Indian Banking Sector”; Forthcoming; Journal of Banking and Finance (JBF)

2001 B.V.Phani & Murali Patibandla, Market Reforms and Industrial Productivity: An Explanation. Economic and Political weekly, Vol XXXVII, No.1, January 5, 2002,

2000 B.V.Phani & Ashish Bhattacharya, Economic Value Added: In search of Relevance.

Decision, Volume 27, No.2, July-Dec 2000, Pg25-55

Other Activities-2006-2008

Chairman Executive Committee, National Conference on Intellectual Property Rights, 28st Feb to 1st March 2007, IIT Kanpur

Member Program Committee-2008-EFA Meeting- Florida 44th Annual Meetings ~ April 9 - 12, 2008; TradeWinds Island Grand Resort; St. Pete Beach, Florida

Member Program Committee- 11th Annual Convention of the Strategic Management Forum; May 10 -12, 2008

Member Management Committee of Endowment Fund-IIT Kanpur

Chairman Senate Election Committee-IIT Kanpur

Member Organizing Committee, National Workshop on Intellectual Property Rights, 31st March to 1st April 2007, IIT Kanpur

Reviewer Management Review, Indian Institute of Management Bangalore

Participant Winter Research Conference on Microstructure of International Financial Markets, Indian School of Business, December 17-19, 2006

Participant National Entrepreneurship Network-STVP EEC Module #2: Introduction to Entrepreneurship Education: Skills, Concepts and Pedagogy, from 3rd to 5th July, at IIM-B, Bangalore.

Chairman Innovators workshop on Grass root innovation, 6th April, 2007

Guest Faculty Institute of Management Khozikode

Guest Faculty SP Jain Institute of Management Bombay

Work Experience

2005 Assistant Professor, Finance & Control, Indian Institute of Technology Kanpur

2004 Assistant Professor, Finance & Control, Indian Institute of Management Calcutta

2003 Consultant, Department for International Development (DFID), U.K

2001 Visiting Research Fellow, Copenhagen Business School

91-95 CEO, Blue Chip Info Tech Ltd., Hyderabad1

90-91 Vice President (operations), Blue Chip Info Tech Ltd., Hyderabad

89-90 General Manager (marketing), Link Well Electronics Ltd., Hyderabad

88-89 Regional Manager (marketing), Link Well Electronics Ltd., Hyderabad

87-88 Marketing Executive, Link Well Electronics Ltd., Hyderabad

Awards

2003 National Stock Exchange Research Initiative award for Research

2001 Copenhagen Business School’s, Aage & Yelva Nimb Foundation award for doctoral research.

2000 PD Agarwal-TCI award of doctoral research

1999 London Business School’s A.V. Birla award for doctoral research

1978 Government of India’s National Merit Scholarship

Teaching Interests

Financial Intermediation, Credit Risk, Corporate Finance, Valuation & Real Options, Entrepreneurial Finance

Research Interests

Financial Intermediaries, Credit Risk Modeling, Securitization, Entrepreneurial Finance, Market Microstructure and valuation

Faculty, Finance

IME-IITKanpur

Coordinator

SIDBI Innovation & Incubation Centre

Indian Institute of Technology Kanpur, Kanpur 208016, Uttar Pradesh, India

Publications

2007 B.V.Phani, Chinmoy Ghosh & John Harding. “Does Liberalization Reduce Agency Costs? Evidence from the Indian Banking Sector”; Forthcoming; Journal of Banking and Finance (JBF)

2001 B.V.Phani & Murali Patibandla, Market Reforms and Industrial Productivity: An Explanation. Economic and Political weekly, Vol XXXVII, No.1, January 5, 2002,

2000 B.V.Phani & Ashish Bhattacharya, Economic Value Added: In search of Relevance.

Decision, Volume 27, No.2, July-Dec 2000, Pg25-55

Other Activities-2006-2008

Chairman Executive Committee, National Conference on Intellectual Property Rights, 28st Feb to 1st March 2007, IIT Kanpur

Member Program Committee-2008-EFA Meeting- Florida 44th Annual Meetings ~ April 9 - 12, 2008; TradeWinds Island Grand Resort; St. Pete Beach, Florida

Member Program Committee- 11th Annual Convention of the Strategic Management Forum; May 10 -12, 2008

Member Management Committee of Endowment Fund-IIT Kanpur

Chairman Senate Election Committee-IIT Kanpur

Member Organizing Committee, National Workshop on Intellectual Property Rights, 31st March to 1st April 2007, IIT Kanpur

Reviewer Management Review, Indian Institute of Management Bangalore

Participant Winter Research Conference on Microstructure of International Financial Markets, Indian School of Business, December 17-19, 2006

Participant National Entrepreneurship Network-STVP EEC Module #2: Introduction to Entrepreneurship Education: Skills, Concepts and Pedagogy, from 3rd to 5th July, at IIM-B, Bangalore.

Chairman Innovators workshop on Grass root innovation, 6th April, 2007

Guest Faculty Institute of Management Khozikode

Guest Faculty SP Jain Institute of Management Bombay

Work Experience

2005 Assistant Professor, Finance & Control, Indian Institute of Technology Kanpur

2004 Assistant Professor, Finance & Control, Indian Institute of Management Calcutta

2003 Consultant, Department for International Development (DFID), U.K

2001 Visiting Research Fellow, Copenhagen Business School

91-95 CEO, Blue Chip Info Tech Ltd., Hyderabad1

90-91 Vice President (operations), Blue Chip Info Tech Ltd., Hyderabad

89-90 General Manager (marketing), Link Well Electronics Ltd., Hyderabad

88-89 Regional Manager (marketing), Link Well Electronics Ltd., Hyderabad

87-88 Marketing Executive, Link Well Electronics Ltd., Hyderabad

Awards

2003 National Stock Exchange Research Initiative award for Research

2001 Copenhagen Business School’s, Aage & Yelva Nimb Foundation award for doctoral research.

2000 PD Agarwal-TCI award of doctoral research

1999 London Business School’s A.V. Birla award for doctoral research

1978 Government of India’s National Merit Scholarship

Teaching Interests

Financial Intermediation, Credit Risk, Corporate Finance, Valuation & Real Options, Entrepreneurial Finance

Research Interests

Financial Intermediaries, Credit Risk Modeling, Securitization, Entrepreneurial Finance, Market Microstructure and valuation

Dr. A M Sakkthivel

Profile:

Dr. A M Sakkthivel is Assistant Professor of Marketing with LIBA, Loyola College, Chennai. India & Recognised PhD supervisor for Madras University, India.

Research Interests

His research interests are Consumer Behavior on Internet Purchase, Post Purchase Behavior, Cyber-Marketing, Virtual Marketing Mix, Virtual Behavioral Process, Retailing Trends, Gauging Brand Loyalty and Modelling Rural Buyer Behavior, Mathematical Modelling (Metrics)

Experience, Publications and Books

He possesses (11 years) of diversified back ground of industrial (Health & Telecom), research, academic and consulting experience. He supervises PhD Students (Full-time) at LIBA Doctoral Research Center (Affiliated to Madras University). He taught in PES Institute of Management, Bangalore, Indian Institute of Science & Management, Ranchi, SIT Tumkur, Kongu Institutions, Erode and Visiting Faculty to many business schools (NIT, Trichy etc). He conducts programmes for senior and middle level executives (SIFY, CITI Group, EPPENDORF etc.). He is authored a Book on “Cyber-Marketing in Indian context” (Maha Maya Publishing House, New Delhi). He published research papers and articles in International Journals (Journal of Internet Banking and Commerce, Canada & South Asian Journal of Management), National Journals (Indian Retail Review, Advertising Express, Journal of Consumer Behavior (ICFAI Press), Indian Journal of Marketing, JIMS 8M, Management Matters, Siddhant etc.,), Dailies (Business Line – Hindu) and E-journals (IndianMBA.com). He also contributed chapters in ICFAI Derivates book on Key Accounts Management and edited books (Organizational Challenges, Excel Books (2001) & Changing Trends in Management, Excel Books (2003)). He presented research papers in National conferences (including AICTE & ICSSR sponsored) across the country. His research papers have been selected for presentation in International Conference on Electronic Business in Hong kong on Dec 2005 and International Conference on Business and Information (BAI 2007) at Tokyo on July 2007.

Consultancy Assignments:

1. Undertaken and successfully completed a consultancy assignment for Indian Railways Consultancy Arm, RITES (Rail India Technical and Economic Services) on identifying passengers’ preferences on modifying coach design. This assignment will be used by Integral Coach Factory, Chennai for modifying existing coach Design. This is first of its kind survey has been conducted among passengers in the history of Indian Railways (Sept, 05). Role: Project Head

2. Lead Consultant (Marketing & Strategic Initiatives) for SAVORIT Limited, a leading player in Pasta Products, Chennai, India.

3. Undertaken and successfully setup a content development team, Recruitment, training, develop quality parameters, performance appraisal system, strategic mapping for a US Based E-learning Solutions company based in Chennai (Aug-Oct, 06): Role: Lead Consultant

Current Research Works:

He involves with several research works viz. Collaboration with National University, Singapore, Gauging Consumer Behavior towards Organized Retail in India, Online retailing in India, Detailed Study on Indian Pharmaceutical Industry in collaboration with the University of Michigan, USA and faculty members from Top B-schools (IIM, XLRI, IIFT, TAPMI etc.), Internet Buying Behavior, Demographic impact on online purchase and Profiling Rural Consumer.

Authored a Book on “Role of Cyber-Marketing in influencing Consumer Buying Behaviour”

Expectations from entries:

I am expecting the finer details financial aspects in the presentation such as projected sales, expenses, breakeven period, profits, a sort of realistic one. Also, if you are selling a product or service, the participants ought to mention the differentiation part, longevity, sustainability, idea of future product/service inclusion etc. Even if you are manufacturing a pin, you have to show the differentiation, market potential, longevity and sustainability of ensuring cash inflow in order to reach breakeven and attain profit.

Dr. A M Sakkthivel is Assistant Professor of Marketing with LIBA, Loyola College, Chennai. India & Recognised PhD supervisor for Madras University, India.

Research Interests

His research interests are Consumer Behavior on Internet Purchase, Post Purchase Behavior, Cyber-Marketing, Virtual Marketing Mix, Virtual Behavioral Process, Retailing Trends, Gauging Brand Loyalty and Modelling Rural Buyer Behavior, Mathematical Modelling (Metrics)

Experience, Publications and Books

He possesses (11 years) of diversified back ground of industrial (Health & Telecom), research, academic and consulting experience. He supervises PhD Students (Full-time) at LIBA Doctoral Research Center (Affiliated to Madras University). He taught in PES Institute of Management, Bangalore, Indian Institute of Science & Management, Ranchi, SIT Tumkur, Kongu Institutions, Erode and Visiting Faculty to many business schools (NIT, Trichy etc). He conducts programmes for senior and middle level executives (SIFY, CITI Group, EPPENDORF etc.). He is authored a Book on “Cyber-Marketing in Indian context” (Maha Maya Publishing House, New Delhi). He published research papers and articles in International Journals (Journal of Internet Banking and Commerce, Canada & South Asian Journal of Management), National Journals (Indian Retail Review, Advertising Express, Journal of Consumer Behavior (ICFAI Press), Indian Journal of Marketing, JIMS 8M, Management Matters, Siddhant etc.,), Dailies (Business Line – Hindu) and E-journals (IndianMBA.com). He also contributed chapters in ICFAI Derivates book on Key Accounts Management and edited books (Organizational Challenges, Excel Books (2001) & Changing Trends in Management, Excel Books (2003)). He presented research papers in National conferences (including AICTE & ICSSR sponsored) across the country. His research papers have been selected for presentation in International Conference on Electronic Business in Hong kong on Dec 2005 and International Conference on Business and Information (BAI 2007) at Tokyo on July 2007.

Consultancy Assignments:

1. Undertaken and successfully completed a consultancy assignment for Indian Railways Consultancy Arm, RITES (Rail India Technical and Economic Services) on identifying passengers’ preferences on modifying coach design. This assignment will be used by Integral Coach Factory, Chennai for modifying existing coach Design. This is first of its kind survey has been conducted among passengers in the history of Indian Railways (Sept, 05). Role: Project Head

2. Lead Consultant (Marketing & Strategic Initiatives) for SAVORIT Limited, a leading player in Pasta Products, Chennai, India.

3. Undertaken and successfully setup a content development team, Recruitment, training, develop quality parameters, performance appraisal system, strategic mapping for a US Based E-learning Solutions company based in Chennai (Aug-Oct, 06): Role: Lead Consultant

Current Research Works:

He involves with several research works viz. Collaboration with National University, Singapore, Gauging Consumer Behavior towards Organized Retail in India, Online retailing in India, Detailed Study on Indian Pharmaceutical Industry in collaboration with the University of Michigan, USA and faculty members from Top B-schools (IIM, XLRI, IIFT, TAPMI etc.), Internet Buying Behavior, Demographic impact on online purchase and Profiling Rural Consumer.

Authored a Book on “Role of Cyber-Marketing in influencing Consumer Buying Behaviour”

Expectations from entries:

I am expecting the finer details financial aspects in the presentation such as projected sales, expenses, breakeven period, profits, a sort of realistic one. Also, if you are selling a product or service, the participants ought to mention the differentiation part, longevity, sustainability, idea of future product/service inclusion etc. Even if you are manufacturing a pin, you have to show the differentiation, market potential, longevity and sustainability of ensuring cash inflow in order to reach breakeven and attain profit.

Prof Priya Kher

Profile:

Head – Corporate Training, SCMHRD

Priya Kher is a Counseling Psychologist, with a Master’s degree in Counseling Psychology from Chicago, U.S.A. She has more than 10 years of experience, and her areas of expertise include Organizational Behaviour, Competency Mapping and Psychometric Testing.

She has been the Chief Learning Officer at Symbiosis Centre for Management and Human Resource Development, where her primary role was to ensure excellence in curriculum development. She was part of Batch One of the Entrepreneurship Educators Course, and was instrumental in setting up the E-cell at SCMHRD in 2005. She is currently involved in Management Development Programmes at SCMHRD.

Expectations from entries:

My first criteria for you to screen (before sending to the jury) would be originality - to ensure that the proposed service/product/business does not already exist, at least in the same form.

My expectations from the entries would be meeting criteria such as comprehensiveness and clarity of idea, USP, innovation, feasibility (customer and market analysis) etc.

Head – Corporate Training, SCMHRD

Priya Kher is a Counseling Psychologist, with a Master’s degree in Counseling Psychology from Chicago, U.S.A. She has more than 10 years of experience, and her areas of expertise include Organizational Behaviour, Competency Mapping and Psychometric Testing.

She has been the Chief Learning Officer at Symbiosis Centre for Management and Human Resource Development, where her primary role was to ensure excellence in curriculum development. She was part of Batch One of the Entrepreneurship Educators Course, and was instrumental in setting up the E-cell at SCMHRD in 2005. She is currently involved in Management Development Programmes at SCMHRD.

Expectations from entries:

My first criteria for you to screen (before sending to the jury) would be originality - to ensure that the proposed service/product/business does not already exist, at least in the same form.

My expectations from the entries would be meeting criteria such as comprehensiveness and clarity of idea, USP, innovation, feasibility (customer and market analysis) etc.

Saturday, December 8, 2007

Prof Veeravalli

Profile:

* Currently Director – Corporate Initiatives & Exec MBA, and Associate Professor, with Great Lakes Institute of Management, Chennai, India, responsible for running the Global Exec MBA program and for generating & conduct of all the Executive Development programs, management consulting and applied research engagements with corporates.

* Head of “Entrepreneurship Development Forum” at the Institute, which shall evolve into an incubation center in the coming years.

* Teaching areas are Negotiation, Entrepreneurship & Business communication.

* Other activities include case writing, guiding students in projects and empirical study

* Written a case in Entrepreneurship on a company in Indian Infrastructure domain for London Business School. Was one of the less than 10 India-centric cases selected out of about 120 proposals and 15 finalists from India

* Member of the TIE Chennai Fund core group, a seed funding and support initiative for budding entrepreneurs from Tamilnadu

* Did/does Management consulting work in Product Supply Chain, Total Quality, Human Resources, Sales & Distribution management, and Business Strategy for FMCG / SME.

* Director in a software co producing Automated Test software

* Last held position as Chief Operating Officer of a tertiary care Super Specialty hospital in Chennai called Harvey Super Specialties Hospital. Continues to be a member of the Management committee

* Previously was the chief Operating Officer handling two FMCG companies in a group in Chennai, one of them a start-up, in Bottled Drinking water and other FMCG products

* Prior to that was General Manager with Godrej Sara Lee Ltd., Mumbai. Headed Product Supply, Total Quality, and HR functions on job rotation. Handled Sales & Distribution before that. Was responsible for achieving spectacular growth of the company sales in south and east zones as the head of sales for these regions

* Became General Manager at 33 years age, one of the youngest in the Godrej group to do so. Had a Fast-Track growth

* Trained ISO 9000 Auditor.

* Was the nominated Chief Executive Officer for ISO 9000 Quality Systems in Godrej Sara Lee Ltd.

* Certified Assessor for CII-EXIM BANK BUSINESS EXCELLENCE AWARD model (which is based on the European Quality Award (EFQM) model). Was part of the team that assessed TATA STEEL.

* Member of the TQM STUDY MISSION to the Union of Japanese Scientists and Engineers (JUSE), JAPAN through CII, to study Total Quality management processes.

* Has taught a course on Quality Management at the Indian Institute of Technology (IIT) School of Management, mumbai, as a Co-faculty

* Other previous experiences include shipping management, projects planning and execution

* Holds a Masters Degree in Sociology. Qualified in Shipping Management.

* Done an accelerated Senior Management Certificate Program (six months duration) with Cornell University, USA, with special focus on Strategy

* Trained in the entrepreneurship teaching under the Stanford Entrepreneurship Educators Program by invitation and done the Entrepreneurship Educator Development Course with Indian School of Business

Expectations from entries:

The key area I would look for in the proposals is – apart from the track/credentials of the team and the power of the idea – is the quality & clarity of understanding of the customers/markets/environs, and the fit/savvy in the ‘to market’ game plan. Most often I find fuzz (and the weakest link) here, with may be a facile ‘porter analysis’ and / or MR data. And I would be cynical towards the ‘numbers’

* Currently Director – Corporate Initiatives & Exec MBA, and Associate Professor, with Great Lakes Institute of Management, Chennai, India, responsible for running the Global Exec MBA program and for generating & conduct of all the Executive Development programs, management consulting and applied research engagements with corporates.

* Head of “Entrepreneurship Development Forum” at the Institute, which shall evolve into an incubation center in the coming years.

* Teaching areas are Negotiation, Entrepreneurship & Business communication.

* Other activities include case writing, guiding students in projects and empirical study

* Written a case in Entrepreneurship on a company in Indian Infrastructure domain for London Business School. Was one of the less than 10 India-centric cases selected out of about 120 proposals and 15 finalists from India

* Member of the TIE Chennai Fund core group, a seed funding and support initiative for budding entrepreneurs from Tamilnadu

* Did/does Management consulting work in Product Supply Chain, Total Quality, Human Resources, Sales & Distribution management, and Business Strategy for FMCG / SME.

* Director in a software co producing Automated Test software

* Last held position as Chief Operating Officer of a tertiary care Super Specialty hospital in Chennai called Harvey Super Specialties Hospital. Continues to be a member of the Management committee

* Previously was the chief Operating Officer handling two FMCG companies in a group in Chennai, one of them a start-up, in Bottled Drinking water and other FMCG products

* Prior to that was General Manager with Godrej Sara Lee Ltd., Mumbai. Headed Product Supply, Total Quality, and HR functions on job rotation. Handled Sales & Distribution before that. Was responsible for achieving spectacular growth of the company sales in south and east zones as the head of sales for these regions

* Became General Manager at 33 years age, one of the youngest in the Godrej group to do so. Had a Fast-Track growth

* Trained ISO 9000 Auditor.

* Was the nominated Chief Executive Officer for ISO 9000 Quality Systems in Godrej Sara Lee Ltd.

* Certified Assessor for CII-EXIM BANK BUSINESS EXCELLENCE AWARD model (which is based on the European Quality Award (EFQM) model). Was part of the team that assessed TATA STEEL.

* Member of the TQM STUDY MISSION to the Union of Japanese Scientists and Engineers (JUSE), JAPAN through CII, to study Total Quality management processes.

* Has taught a course on Quality Management at the Indian Institute of Technology (IIT) School of Management, mumbai, as a Co-faculty

* Other previous experiences include shipping management, projects planning and execution

* Holds a Masters Degree in Sociology. Qualified in Shipping Management.

* Done an accelerated Senior Management Certificate Program (six months duration) with Cornell University, USA, with special focus on Strategy

* Trained in the entrepreneurship teaching under the Stanford Entrepreneurship Educators Program by invitation and done the Entrepreneurship Educator Development Course with Indian School of Business

Expectations from entries:

The key area I would look for in the proposals is – apart from the track/credentials of the team and the power of the idea – is the quality & clarity of understanding of the customers/markets/environs, and the fit/savvy in the ‘to market’ game plan. Most often I find fuzz (and the weakest link) here, with may be a facile ‘porter analysis’ and / or MR data. And I would be cynical towards the ‘numbers’

Dr Padma Srinivasan

Profile:

Dr.Padma Srinivasan, M.Com, ACS & Ph.D in finance area, has 12 years of industrial experience as HR & Company secretary and 10 years as a teacher.She has been teaching the MBA program at ICFAI Business School, Bangalore as Professor- Law & Accounting for the past 2 years, has won twice 'Best Research Paper' awards and has authored more than 75 research articles.She is the faculty lead of Entrepreneurship and has attended the Stanford educators course.She is pursuing the Advanced course on entrepreneurship with NEN& ISB. Dr. Padma is also the consulting Editor of ICFAI Journal of Risk & Insurance and has published 2 derivative books.

Expectations from entries:

1.Workable business plans

2.Entrepreneurial spirit & perseverance

3.Committed thinking process and

4.Right attitude

Dr.Padma Srinivasan, M.Com, ACS & Ph.D in finance area, has 12 years of industrial experience as HR & Company secretary and 10 years as a teacher.She has been teaching the MBA program at ICFAI Business School, Bangalore as Professor- Law & Accounting for the past 2 years, has won twice 'Best Research Paper' awards and has authored more than 75 research articles.She is the faculty lead of Entrepreneurship and has attended the Stanford educators course.She is pursuing the Advanced course on entrepreneurship with NEN& ISB. Dr. Padma is also the consulting Editor of ICFAI Journal of Risk & Insurance and has published 2 derivative books.

Expectations from entries:

1.Workable business plans

2.Entrepreneurial spirit & perseverance

3.Committed thinking process and

4.Right attitude

Friday, December 7, 2007

FAQ 1

Q: What process would be followed for verifying the age of each team member?

Ans: If you are selected for the second stage of i2I, the Pitch round, you need to produce an age proof attested by a gazetted officer at the venue of the pitch stage.

Ans: If you are selected for the second stage of i2I, the Pitch round, you need to produce an age proof attested by a gazetted officer at the venue of the pitch stage.

Thursday, December 6, 2007

Prof Arya Kumar

Profile:

Prof Arya Kumar did his PhD from Birla Institute of Technology & Science, Pilani in the year 1982 in the area of Financial Management of Higher Education in India. He has a diversified experience for more than 29 years of serving in educational institutions, research organizations, banks and financial institutions. He was associated with Project Lending, Investment Banking, Reconstruction of Sick Units and all other aspects of managing a zone in his last assignment in IIBI - an All India Financial Institution as Chief General Manager and Zonal Head at New Delhi. He has served as Director on the Board of number of companies dealing in the area of telecommunication, metal, resins, sugar, aluminum casting, cable manufacturing etc. Earlier he was involved in strategic planning, research in banking in Canara Bank and designing, developing and conducting various training programmes for middle and senior level officers at an apex college of Indian Bank in the area of Project Finance, Management Development, Merchant Banking, HRD, Credit Appraisal etc. He was Guest Faculty with number with leading management institutions and colleges of various Banks. He has participated in number of training programmes conducted by National Institute of Bank Management, Management Development Institute, International Management Institute etc.and has undergone training in the area of entrepreneurship conducted by STVP, Stanford organised by National Entrepreneurship Network.He is presently Group Leader of Economics & Finance Group, BITS, Pilani. He is a Faculty Coordinator for the activities of Center for Entrepreneurial Leadership at BITS, Pilani. His basic interests lie in Entrepreneurship, Strategic Management, Values in Management and Financial Management. He has contributed many research articles in National Journals and Economic Dailies. He is a member of the National Entrepreneurship Network (NEN) India Faculty Advisory Board.

Expectations from entries:

Executive Summary of the BP covering key aspects of innovative idea, workability, basis for it being an opportunity, future market potential, financial plan gist and above all TEAM backing it.

Prof Arya Kumar did his PhD from Birla Institute of Technology & Science, Pilani in the year 1982 in the area of Financial Management of Higher Education in India. He has a diversified experience for more than 29 years of serving in educational institutions, research organizations, banks and financial institutions. He was associated with Project Lending, Investment Banking, Reconstruction of Sick Units and all other aspects of managing a zone in his last assignment in IIBI - an All India Financial Institution as Chief General Manager and Zonal Head at New Delhi. He has served as Director on the Board of number of companies dealing in the area of telecommunication, metal, resins, sugar, aluminum casting, cable manufacturing etc. Earlier he was involved in strategic planning, research in banking in Canara Bank and designing, developing and conducting various training programmes for middle and senior level officers at an apex college of Indian Bank in the area of Project Finance, Management Development, Merchant Banking, HRD, Credit Appraisal etc. He was Guest Faculty with number with leading management institutions and colleges of various Banks. He has participated in number of training programmes conducted by National Institute of Bank Management, Management Development Institute, International Management Institute etc.and has undergone training in the area of entrepreneurship conducted by STVP, Stanford organised by National Entrepreneurship Network.He is presently Group Leader of Economics & Finance Group, BITS, Pilani. He is a Faculty Coordinator for the activities of Center for Entrepreneurial Leadership at BITS, Pilani. His basic interests lie in Entrepreneurship, Strategic Management, Values in Management and Financial Management. He has contributed many research articles in National Journals and Economic Dailies. He is a member of the National Entrepreneurship Network (NEN) India Faculty Advisory Board.

Expectations from entries:

Executive Summary of the BP covering key aspects of innovative idea, workability, basis for it being an opportunity, future market potential, financial plan gist and above all TEAM backing it.

Prof MS Rao

Profile:

Prof M Suresh Rao is the Professor for Entrepreneurship and Chairperson, Center for Entrepreneurship at SPJIMR. He is the Co-ordinator of the pioneering 'Start Your Business Program' for budding entrepreneurs who also have access to the incubation facility at the Center. Prof Rao, an alumnus of IIM A, has wide industry exposure to marketing turnarounds and growing new ventures in different industries. He is a resource person for mentoring start up entrepreneurs, for guest lectures on entrepreneurship and for evaluating/jurying national level Business Plan competitions.

Expectations from entries:

The team must also indicate how much funding they need for what outcomes..

Prof M Suresh Rao is the Professor for Entrepreneurship and Chairperson, Center for Entrepreneurship at SPJIMR. He is the Co-ordinator of the pioneering 'Start Your Business Program' for budding entrepreneurs who also have access to the incubation facility at the Center. Prof Rao, an alumnus of IIM A, has wide industry exposure to marketing turnarounds and growing new ventures in different industries. He is a resource person for mentoring start up entrepreneurs, for guest lectures on entrepreneurship and for evaluating/jurying national level Business Plan competitions.

Expectations from entries:

The team must also indicate how much funding they need for what outcomes..

Radha Iyer

Profile:

Radha Iyer is qualified as a Masters in Administration Management from Jamnalal Bajaj Institute of Management Studies; prior to this she has a Bachelor of Arts and a Diploma in Hotel Management and Catering Technology. She is now pursuing a PhD from SNDT University in Employee training and Development for Non-profit organizations. She is a recognized management teacher by both, Mumbai University and All India Management Association. She has eleven years of industry experience having worked with Indian Hotels Company Limited, (The Taj group of Hotels), Marico Industries and The Great Eastern Shipping Company Limited. For the past eleven years she has been an academician, facilitating courses on Human Resources Management, Organization Behavior, Training and Development and Entrepreneurship Management. She has been an assessor for development centers conducted for the hotels and travel organizations. She has also been involved with training for the Income tax department, Chartered Accountants and young engineers. Her industry interaction includes a project on Attrition/Labour turnover in the private insurance industry. Her other interests include, facilitating Social projects and the entrepreneurship cell on campus. In the past she has been involved as faculty placement coordinator. She is the recipient of the Vijay Mallya National Entrepreneurship Network fellowship for Entrepreneurship education in 2007.

Expectations from entries:

Expectations from the entries would include, the idea, market attractiveness, competitor analysis, entry and growth strategy, how the business model is, team, profitability, is it worth the investment, presentation and the quality of work done.

Radha Iyer is qualified as a Masters in Administration Management from Jamnalal Bajaj Institute of Management Studies; prior to this she has a Bachelor of Arts and a Diploma in Hotel Management and Catering Technology. She is now pursuing a PhD from SNDT University in Employee training and Development for Non-profit organizations. She is a recognized management teacher by both, Mumbai University and All India Management Association. She has eleven years of industry experience having worked with Indian Hotels Company Limited, (The Taj group of Hotels), Marico Industries and The Great Eastern Shipping Company Limited. For the past eleven years she has been an academician, facilitating courses on Human Resources Management, Organization Behavior, Training and Development and Entrepreneurship Management. She has been an assessor for development centers conducted for the hotels and travel organizations. She has also been involved with training for the Income tax department, Chartered Accountants and young engineers. Her industry interaction includes a project on Attrition/Labour turnover in the private insurance industry. Her other interests include, facilitating Social projects and the entrepreneurship cell on campus. In the past she has been involved as faculty placement coordinator. She is the recipient of the Vijay Mallya National Entrepreneurship Network fellowship for Entrepreneurship education in 2007.

Expectations from entries:

Expectations from the entries would include, the idea, market attractiveness, competitor analysis, entry and growth strategy, how the business model is, team, profitability, is it worth the investment, presentation and the quality of work done.

Rajeev Roy

RAJEEV ROY

PGDM (IIM, A) PhD (Utkal) (awaiting grant)

Profile:

After a brief stint in a multinational consulting firm, he started his own aquaculture business in 1997. Later he forward integrated into export of shrimps and exotic fishes. He stopped the business in 2001 and started a BPO which was into web and voice enabled CRM. He sold the firm in 2005 and started teaching entrepreneurship at XIMB. He is currently the coordinator for the centre for entrepreneurship at XIMB.

He also teaches entrepreneurship at the Sellinger Business School at Baltimore, USA, as visiting faculty. He is also advisor to the state governments of Orissa and Chattisgarh vis a vis their policy for attracting entrepreneurs. He is also involved in conducting entrepreneurship development programs in Chile and Canada. He has written a book on entrepreneurship which will be released by a major publisher in a few months time.

Expectations from entries:

While having a look at the executive summary, I will place a lot of weightage on the quality of the idea.

PGDM (IIM, A) PhD (Utkal) (awaiting grant)

Profile:

After a brief stint in a multinational consulting firm, he started his own aquaculture business in 1997. Later he forward integrated into export of shrimps and exotic fishes. He stopped the business in 2001 and started a BPO which was into web and voice enabled CRM. He sold the firm in 2005 and started teaching entrepreneurship at XIMB. He is currently the coordinator for the centre for entrepreneurship at XIMB.

He also teaches entrepreneurship at the Sellinger Business School at Baltimore, USA, as visiting faculty. He is also advisor to the state governments of Orissa and Chattisgarh vis a vis their policy for attracting entrepreneurs. He is also involved in conducting entrepreneurship development programs in Chile and Canada. He has written a book on entrepreneurship which will be released by a major publisher in a few months time.

Expectations from entries:

While having a look at the executive summary, I will place a lot of weightage on the quality of the idea.

Tuesday, December 4, 2007

FAQ

Q: Please let me know if we can also submit a plan which shall be implemented through a not-for-profit organization.

Ans: Every venture must make profits, though modest, to sustain itself in the long run. Profits does not mean that they have to go to the equity holders, the profits can be re-routed into the firm's activities. Therefore if your plan makes profits but uses them in the activities of the firm, then it will be accepted. A not-for- profit organization per-se is not allowed within the purview of I2i.

Q: Do we have to use the prize money of INR 1 crore for developing a financial plan for starting a business?

Ans: The prize money of 1 crore is in the form of seed funding and will be used to implement the plan. It would be better if you already had a financial plan for the startup, not only for the venture capitalist but also from the competition point of view. The judges may ask you to give your financial plan in case you get/ not get the prize money.

Ans: Every venture must make profits, though modest, to sustain itself in the long run. Profits does not mean that they have to go to the equity holders, the profits can be re-routed into the firm's activities. Therefore if your plan makes profits but uses them in the activities of the firm, then it will be accepted. A not-for- profit organization per-se is not allowed within the purview of I2i.

Q: Do we have to use the prize money of INR 1 crore for developing a financial plan for starting a business?

Ans: The prize money of 1 crore is in the form of seed funding and will be used to implement the plan. It would be better if you already had a financial plan for the startup, not only for the venture capitalist but also from the competition point of view. The judges may ask you to give your financial plan in case you get/ not get the prize money.

Tuesday, November 27, 2007

Tremendous Media Coverage for i2I

i2I’08 was launched on the 24th of November and has elicited tremendous response from the media community. Given below are a few links:

http://www.indiaprwire.com/businessnews/20071125/25720.htm

http://in.news.yahoo.com/top_section_news.html

http://www.indiasnews.com/News-2348958.html

http://www.thebig.tv/view_video.php?viewkey=177c17d0d17ff7358430

http://www.expressindia.com/latest-news/Annual-festival-of-IIMC-to-begin-in-Dec/243222/

http://www.coolavenues.com/bschools/071105/iimc-i2i-1.php

http://mangalorean.com/news.php?newstype=local&newsid=59152

Sunday, November 25, 2007

Dealing with a Venture Capitalist !

A Sample Memorandum of Understanding

Between Investee Pvt. Limited (Investee) and Seed Ventures (“Investor”)

Please note that the terms indicated in this draft are only indicative of the nature of agreement made between an entrepreneurial startup and an investor organization. Do not take it to be a legal document.

This is only for your reference and understanding of how deals with VC organizations are worked.

This summarises an offer made to Investee by “Investor”, and accepted by Investee. This document by itself is not the actual legal agreement, but is the framework on which legal agreements will be drawn up.

1. Investee seeks to build out a business based on XYZ

2. “Investor” would like to help Investee become the leading player in its space in India, through infusion of funding and advice.

3. Investee is represented by Promoter One and Promoter Two (“Promoters”). “Investor” is represented by Mr. X, Y and Z. (“Investor”).

4. “Investor” agrees to buy a stake of x% in Investee for a consideration of Rs. XX crores.

5. “Investor” believes that a key factor in retaining and motivating Investee employees will be their participation in the equity upside of the company. One condition to this agreement is that Investee will create a pool of ESOPs of up to 7% of the company’s stock, to be kept aside for distribution to non-promoter full-time employees of the company.

6. Investee will re-constitute its Board as follows: a three-member board, with one person a representative of the Promoters, one a “Investor” representative and a third will be an independent professional nominated by the Promoters and approved by “Investor”.

7. “Investor” believes that early-stage businesses require regular advice and mentoring. “Investor” agrees to offer the following:

a. Appointment of a “lead partner” for Investee from among the fund’s partners, agreed to by both parties – who will be the primary point of contact with Investee

b. Best efforts for connectivity with business and referrals that could be useful to Investee.

c. Availability of lead partner on an on-going basis for meetings and other advisory sessions with the Investee team

d. The services of other “Investor” people on an if-available basis when requested by the Investee team

8. The above describe specific points in the agreement. We will now lay out other “Standard template” points that are likely to be present in the legal agreement.

a. The agreement, because of its variable, success-based nature, is likely to be in the form of a combination of equity and convertible debentures.

b. Promoters need to attest to “Investor” that all the shareholding by various people and entities in Investee is fully disclosed, along with the family and other relationships that exist between all shareholders.

c. Investee will need to execute employment, non-compete, confidentiality and other agreements with its promoters and key staff to the satisfaction of “Investor”

d. Promoters and other Investee people will need to execute agreements to the satisfaction of “Investor” that transfer all copyrights, trademarks, domain names or other rights relating to Investee’s business to the Investee company.

e. Investee will indemnify “Investor” against all losses and claims that can arise from any or all third parties in the course of Investee’s business

f. Investee will give “Investor” and its affiliates the right to maintain current level of stake holding in the next round too, by letting it subscribe to financial instruments at the price determined by the lead investor in that round.

g. Promoters will commit not to pledge, mortgage, sell or otherwise raise a lien on any or all of their stock in Investee without “Investor”’s permission

h. In case Investee is dissolved or wound up, the proceeds of this dissolution shall first go to clear the cost basis of “Investor”’s investment, and only then shall the remaining assets be divided between all investors in the ratio of their shareholdings

i. In case Investee is sold or merged into another business, the proceeds of the event shall be distributed as follows: the first sum worth a minimum of 2x of “Investor”’s investment shall be payable to “Investor”. In case the proceeds due to “Investor” are greater than 2x of its investment, then all proceeds shall be distributed in proportion to the shareholders’ stake in the company, in such a way that “Investor” always receives a sum which is the greater of the two options.

j. Both parties expect that Investee will be ready for an IPO within about 5 years of the date of investment. All shareholders may offer a percentage of their shares for sale in the same promotion, with “Investor” having a right to offer greater than the others’ proportion of shares. “Investor” shall not be considered a “promoter” in the company, and “Investor”’s shares shall not be subject to lock-up provisions.

k. Promoters shall have operational control of Investee – but the following will require the approval of “Investor”:

i. The creation of any new shares or class of security or financial instrument in the company

ii. Any amendment to the powers and rights of “Investor”

iii. Any issue of debt in the company of more than Rs. 10 lakhs

iv. Any change of control in the company

v. Any amendment to business plan or budget

vi. Any change in accounting / tax policies

vii. Any changes to the rights of common stock owners

viii. Any changes in the company by-laws or the articles of incorporation or memorandum and articles of association of the company

ix. Any changes in the board of directors

x. Any appointment / terminations of senior personnel in the company

xi. Terms of employment and changes in remuneration of the promoters

xii. Any change in the company’s line of business

xiii. Any restructuring, merger / acquisition / sale of whole or part of the company

xiv. Any creation of subsidiaries / entering into partnerships / alliances / joint ventures

xv. Any sale of assets greater than Rs. 15 lakhs

xvi. Any purchases greater than Rs. 10 lakhs

9. The agreement will close subject to accounting and legal due diligence, completion of legal documentation and no material or adverse change in situation and law.

l. “Investor” shall have the right of first refusal if Promoters want to create and sell new or existing shares in the company

m. “Investor” and Investee will agree to standard reporting frequency and data in reports

n. If the promoters wish to sell their shares to an outside party, “Investor” shall have tag-along / drag-along rights – i.e. the rights to also sell its stake at the same terms

o. Investee will obtain key person insurance for its Promoters at reasonable cost

p. Investee will obtain D&O insurance for its directors at reasonable cost

q. Investee will retain an auditing firm of repute, satisfactory to “Investor”

10. All terms of this agreement shall be kept in total confidence by Promoters and Investee

11. On the acceptance of this MoU, the promoters shall agree to cease all negotiations with any other investing parties for a period of 60 days, or till the legal agreement with “Investor” is completed, whichever comes later.

12. “Investor” hopes to use its resources to help make Investee a big success – and looks forward to a warm cordial working relationship with all Investee promoters and staff.

Signed,

For Investee For “Investor”

Saturday, November 24, 2007

The i2I Invite!

The Day of the Launch Arrives!

The Challenge Begins Now

Be a part of this historical National Entrepreneurship Challenge - Visit us at

www.iimcal.ac.in/i2i

The Challenge Begins Now

Be a part of this historical National Entrepreneurship Challenge - Visit us at

www.iimcal.ac.in/i2i

i2I '08

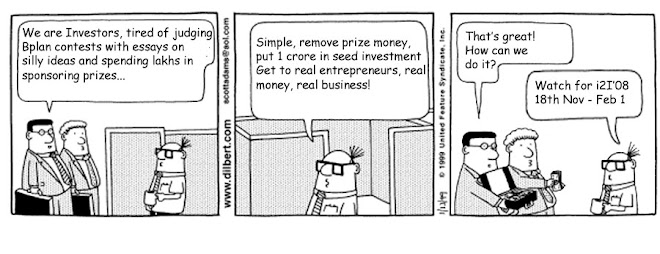

As a curious onlooker, i2I might come across as another B-plan writing contest where you send in your executive summaries, get into subsequent rounds based on how good you and your plan are, and end up being happy that you made it to the top 1-2 positions, subsequently forgetting about it. However, the similarity ends there.

The objective of i2I is to move away from the traditional Business Plan contests which turn out to be paper-writing competitions and proof of concepts, rather than the endeavour of an entrepreneur to see his dream turn to reality. i2I strives to promote only those plans which are backed by serious and dedicated teams, which have the potential to turn to successful ventures based on financial support..

The participants can be students as well as working professionals, and this means the contest is not merely academic in nature, rather an idea building up to a venture. The offering of seed investment only while starting up, rather than cash prizes to the winners shows that entrepreneurship is serious business and i2I means business. Start-up investments of the order of crores to plans that might still be in the incubation stage just shows how serious i2I is about the execution. The mentoring of the budding entrepreneurs by a team of experts will provide a level playing field to the students to match up to their working counterparts to do well in the investor marketplace. The judging parameters might not only be the best plan, but the determination and seriousness of the entrepreneur to carry it out.

One thing about the winner of i2I '08 is already known. The winning team will be a set of resolute entrepreneurs with a sound plan, who will have to hold fort under tough scrutiny. Success at the final level at i2I would mean a great chance for the entrepreneur to seek further partners and investors he would be trained and exposed enough to face the future, much better prepared and much more confident to succeed in the real world.

In future, it would come as no surprise if a number of successful entrepreneurs claim that this is where it started for them – i2I helped them take their first steps into business superstardom.

Written by:

Kaushik Saha

The objective of i2I is to move away from the traditional Business Plan contests which turn out to be paper-writing competitions and proof of concepts, rather than the endeavour of an entrepreneur to see his dream turn to reality. i2I strives to promote only those plans which are backed by serious and dedicated teams, which have the potential to turn to successful ventures based on financial support..

The participants can be students as well as working professionals, and this means the contest is not merely academic in nature, rather an idea building up to a venture. The offering of seed investment only while starting up, rather than cash prizes to the winners shows that entrepreneurship is serious business and i2I means business. Start-up investments of the order of crores to plans that might still be in the incubation stage just shows how serious i2I is about the execution. The mentoring of the budding entrepreneurs by a team of experts will provide a level playing field to the students to match up to their working counterparts to do well in the investor marketplace. The judging parameters might not only be the best plan, but the determination and seriousness of the entrepreneur to carry it out.

One thing about the winner of i2I '08 is already known. The winning team will be a set of resolute entrepreneurs with a sound plan, who will have to hold fort under tough scrutiny. Success at the final level at i2I would mean a great chance for the entrepreneur to seek further partners and investors he would be trained and exposed enough to face the future, much better prepared and much more confident to succeed in the real world.

In future, it would come as no surprise if a number of successful entrepreneurs claim that this is where it started for them – i2I helped them take their first steps into business superstardom.

Written by:

Kaushik Saha

Thursday, November 22, 2007

Saturday, November 17, 2007

Some inspirational videos

Steve Jobs Stanford Commencement Speech 2005

The Great Dictator - speech by Charlie Chaplin

Al Pacino's Inspirational Speech

Take Ownership & Decide your Own Development

The Great Dictator - speech by Charlie Chaplin

Al Pacino's Inspirational Speech

Take Ownership & Decide your Own Development

Subscribe to:

Posts (Atom)