As a curious onlooker, i2I might come across as another B-plan writing contest where you send in your executive summaries, get into subsequent rounds based on how good you and your plan are, and end up being happy that you made it to the top 1-2 positions, subsequently forgetting about it. However, the similarity ends there.

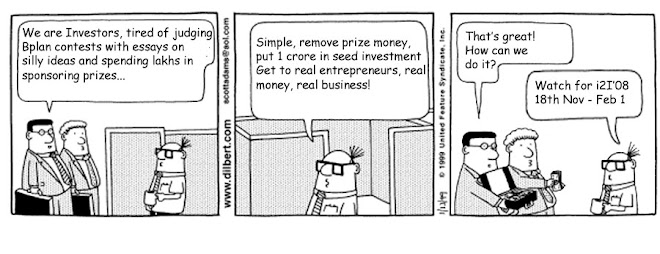

The objective of i2I is to move away from the traditional Business Plan contests which turn out to be paper-writing competitions and proof of concepts, rather than the endeavour of an entrepreneur to see his dream turn to reality. i2I strives to promote only those plans which are backed by serious and dedicated teams, which have the potential to turn to successful ventures based on financial support..

The participants can be students as well as working professionals, and this means the contest is not merely academic in nature, rather an idea building up to a venture. The offering of seed investment only while starting up, rather than cash prizes to the winners shows that entrepreneurship is serious business and i2I means business. Start-up investments of the order of crores to plans that might still be in the incubation stage just shows how serious i2I is about the execution. The mentoring of the budding entrepreneurs by a team of experts will provide a level playing field to the students to match up to their working counterparts to do well in the investor marketplace. The judging parameters might not only be the best plan, but the determination and seriousness of the entrepreneur to carry it out.

One thing about the winner of i2I '08 is already known. The winning team will be a set of resolute entrepreneurs with a sound plan, who will have to hold fort under tough scrutiny. Success at the final level at i2I would mean a great chance for the entrepreneur to seek further partners and investors he would be trained and exposed enough to face the future, much better prepared and much more confident to succeed in the real world.

In future, it would come as no surprise if a number of successful entrepreneurs claim that this is where it started for them – i2I helped them take their first steps into business superstardom.

Written by:

Kaushik Saha